2025 Proposed Levies: Some voters will see tax levies on their ballot this Nov 4th

Some Clermont County voters will see proposed tax levies on their November 4, 2025, ballot. If approved, these levies will impact annual real estate taxes beginning as early as Tax Year 2025, with collections starting in 2026 for most property owners.

How Will the Levies Affect Your Property Taxes?

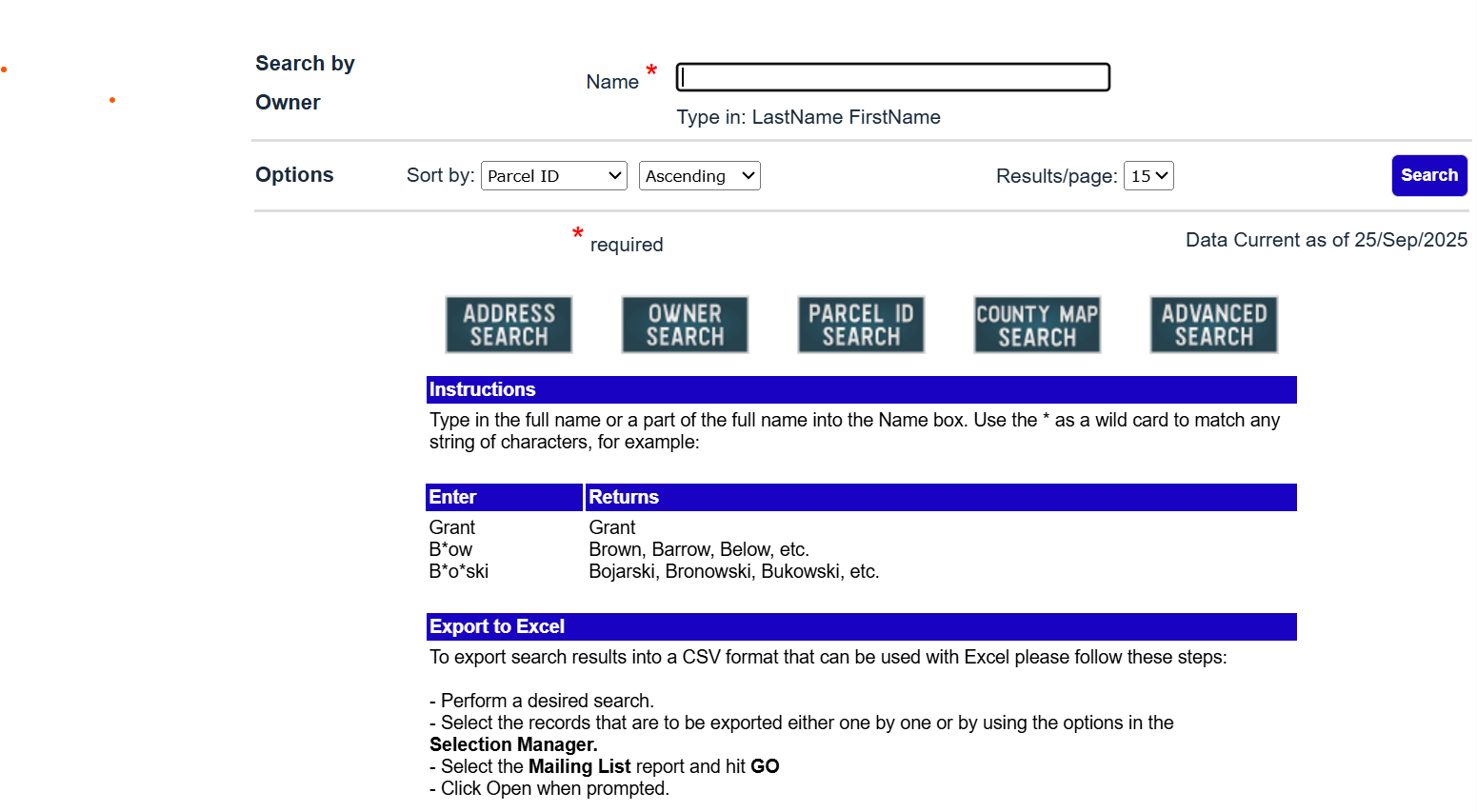

You can estimate the impact of proposed levies on your property taxes using the Levy Calculator. Here’s how:

-

Use the Property Search Tool to locate your property, you can search by name, address, or parcel number

-

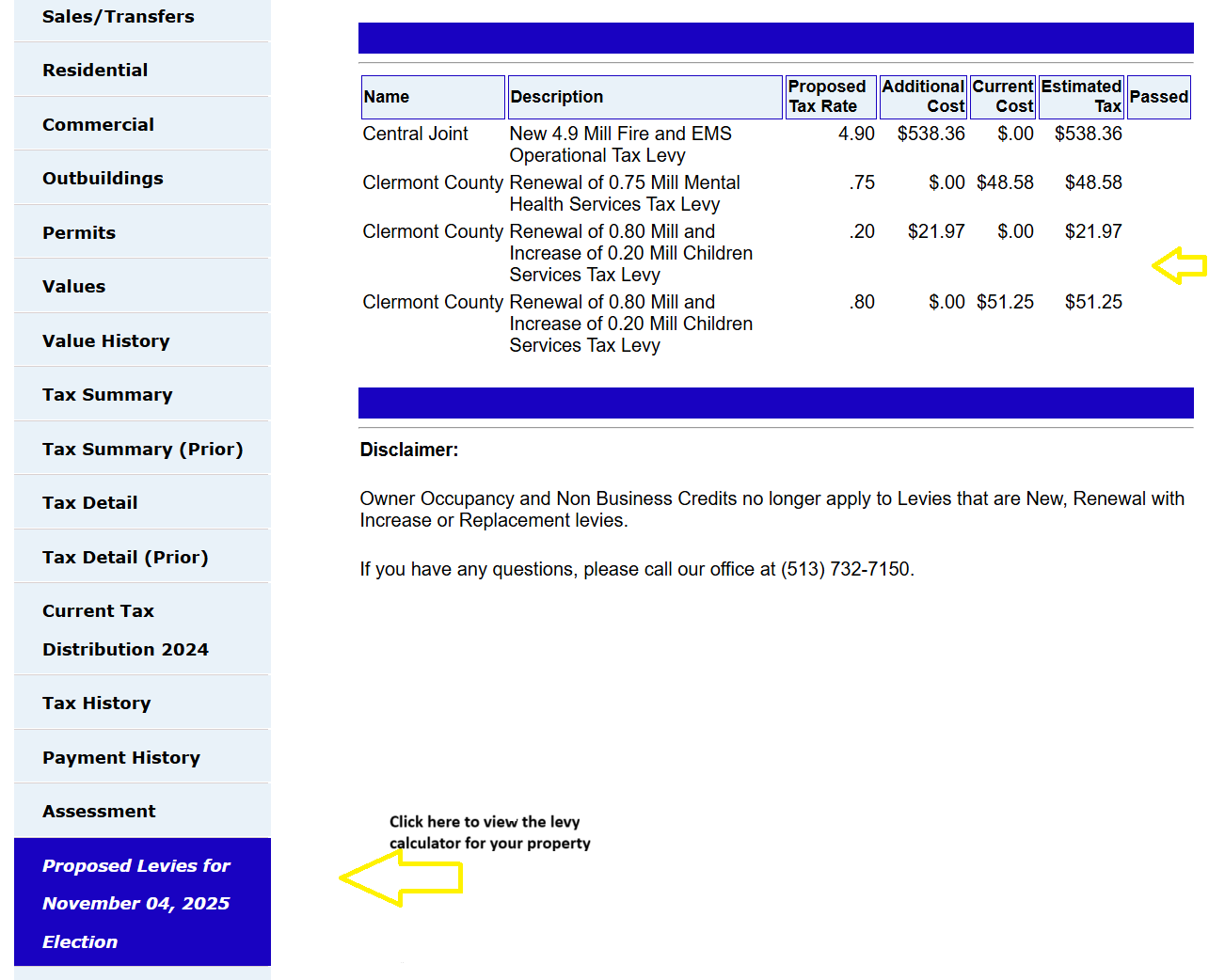

Once your property information appears, click the “Proposed Levies for November 4, 2025 Election” link on the left side of that screen (highlighted in blue). This will display estimated annual costs for any levies impacting your property. (See example below)

Types of Levies on the Ballot

-

Renewal Levies Continue existing levies at their current (unchanged) millage rate. These do not increase taxes.

-

Replacement Levies Reset existing levies’ reduced millage rates to their original full rate. This typically results in a higher tax amount.

-

Additional Levies Introduce new taxes to generate additional revenue, thereby increasing your overall tax rate.

Voting Information-For up-to-date information about the upcoming election, visit the Clermont County Board of Elections.

Please Note: The levy cost estimates are provided for informational purposes only.

They do not represent an endorsement for or against any proposed levy.